These observations are initially based upon what we have learned via these conversations and our observations. Nonetheless it was not ample. To again them up, we also needed to trust in dependable resources

A mortgage Take note is usually a promissory Observe that specifics the repayment terms of a financial loan utilised to buy a assets. It’s like an IOU, and it information the repayment recommendations, including:

It keeps you from squandering time shopping for properties outside the house your spending budget, and in a few hot seller’s marketplaces, a property agent might not fulfill with you until you've got a preapproval letter.

Different lenders have a bit different underwriting demands, and even if you’re preapproved with every single lender, you may learn that the rate and phrases you’re offered fluctuate.

Or, your credit score might not be good enough to qualify. Any mortgage software will require a credit rating Examine, so you critique your credit rating report beforehand to be certain your credit history is in fantastic condition.

But that’s not the situation when you fall short to generate personalized financial loan payments, such as. Considering the fact that own financial loans are unsecured, you don’t have to bother with shedding your own home or almost every other asset in case you drop driving on payments.

VA financial loans are an excellent option because, when you qualify, You should purchase a home for 0% down, and you Mortgage Broker Lee received’t pay out mortgage insurance policies.

After you make your monthly mortgage payment, every one looks like just one payment created to one receiver. But mortgage payments basically are damaged into various distinctive parts.

This distinction amongst possession rights and residency rights is vital for arranging your residence use.

Deposit: The deposit is the level of a home’s obtain selling price a homebuyer pays upfront. Buyers normally set down a share of the home’s worth, then borrow The remainder in the form of a mortgage. Unique kinds of mortgages have varying bare minimum down payments.

For instance, a household homebuyer pledges their property to their lender, which then has a assert within the property. This makes sure the lender’s fascination within the assets need to the buyer default on their own fiscal obligation.

Though the Federal Reserve doesn’t set mortgage charges, sector desire charges reply to variations inside the federal cash charge.

These homeowners can borrow versus the value of their household and get The cash like a lump sum, preset month to month payment, or line of credit. Your entire loan stability results in being due once the borrower dies, moves absent completely, or sells the house.

Distinctive government-backed programs permit more people to qualify for mortgages and make their dream of homeownership a actuality, but comparing the very best mortgage prices will make the home-purchasing procedure much more inexpensive.

Mr. T Then & Now!

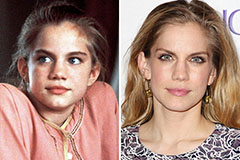

Mr. T Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!